It’s fine and all to picture your grandparents sitting hand in hand on their porch, drinking coffee, basking in the glow of their golden years. But you getting old? Haha! That’ll never happen.

No one looks forward to getting old. And while people like to say age is just a number, eventually age is the number of hip replacements you’ve had. The reality is that we all age, and as we do, ongoing health challenges can rob us of our mobility and independence. Before you know it, you’re paying thousands of dollars a month for someone to help you do everyday activities like getting dressed and cooking.

This is where long-term care insurance comes in. Having it means you have a plan for your future—and a plan can make a huge difference.

If you want to protect your nest egg, take some of the burden off family members, and be more in control of how you spend your golden years, long-term care insurance is a must!

But what is long-term care insurance? Let’s dive in.

What Is Long-Term Care Insurance?

What Does Long-Term Care Insurance Cover?

Types of Long-Term Care Insurance Policies

Understanding State Partnership Plans

How Does Long-Term Care Insurance Work?

What Disqualifies You From Long-Term Care Insurance?

When Will Long-Term Care Insurance Benefits Become Available?

Cost of Long-Term Care Insurance

Who Usually Pays for Long-Term Care?

Why Buy Long-Term Care Insurance?

Tax Advantages of Buying Long-Term Care Insurance

When to Buy Long-Term Care Insurance

How to Buy Long-Term Care Insurance

The Best Way to Get Long-Term Care Insurance

What Is Long-Term Care?

Long-term care is any care that lasts longer than three months and involves help with daily activities like bathing, dressing, cooking, cleaning and even just moving around. While we tend to immediately think of nursing homes for care like that, you can also receive long-term care at home and in places like adult day care centers. People need long-term care for several reasons: a long, debilitating illness, injury or disability; a sudden health event like a stroke; or simply getting older and frailer.

People need long-term care for several reasons: a long, debilitating illness, injury or disability; a sudden health event like a stroke; or simply getting older and frailer.

Most of the time, a spouse or family members provide long-term care for their loved one free of charge. While this may be the ideal scenario, it’s not always possible. That’s when professionals step in—either coming to your home or providing a facility for your care.

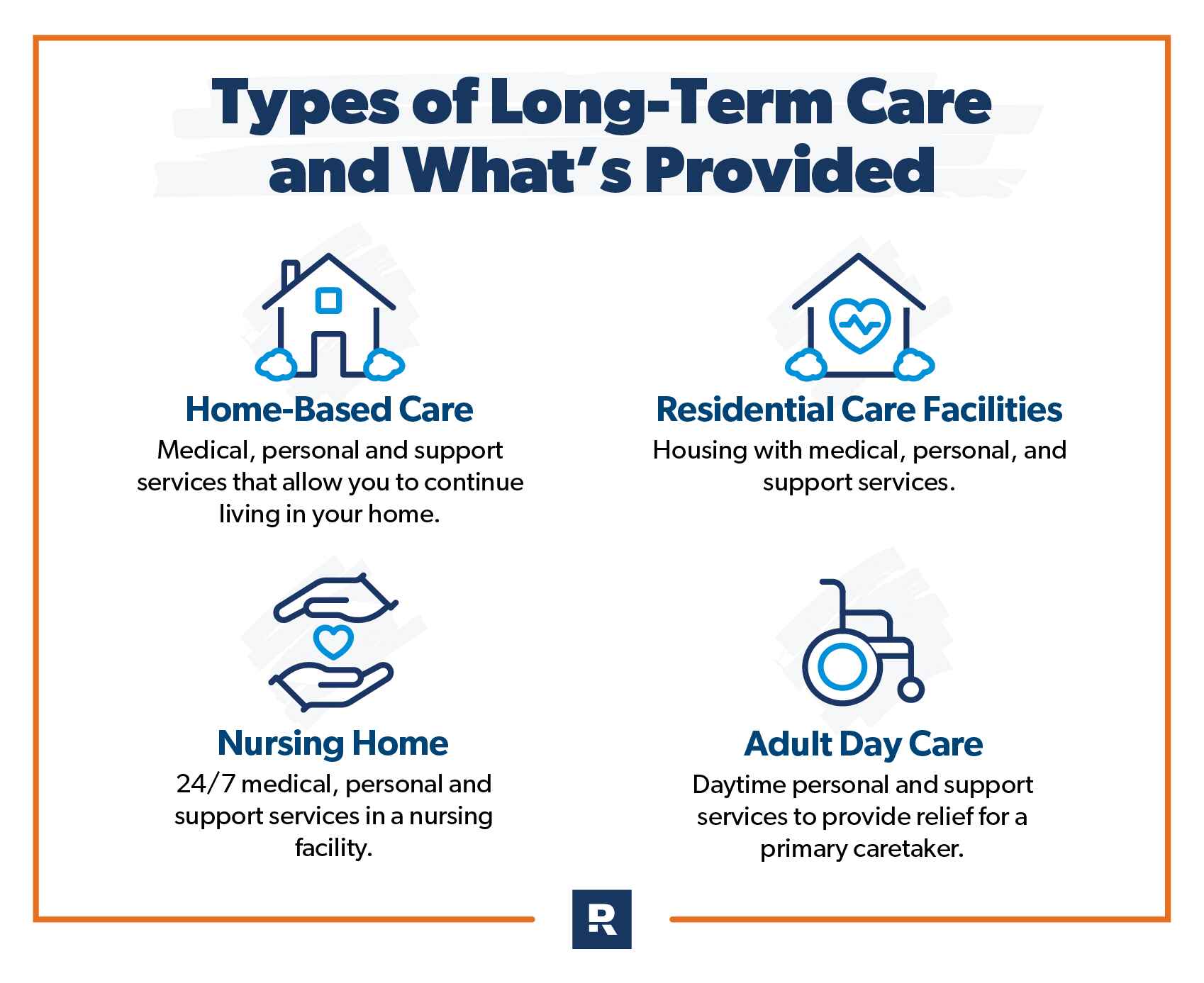

|

Types of Long-Term Care |

What’s Provided |

|

Home-based care |

Medical, personal and support services that allow you to continue living in your home |

|

Residential care facilities |

Housing with medical, personal and support services. |

|

Nursing home |

24/7 medical, personal and support services in a nursing facility |

|

Adult day care |

Daytime personal and support services to provide relief for a primary caretaker. |

Will I Need Long-Term Care?

You could die in a car accident. You could die in an ostrich attack. Or you could live to be 102 and need help getting out of bed for the last 10 years. Today’s 65-year-olds have a 70% chance of needing long-term care, and an estimated 20% of Americans will need it for longer than five years.1 So odds are, you’ll need it.

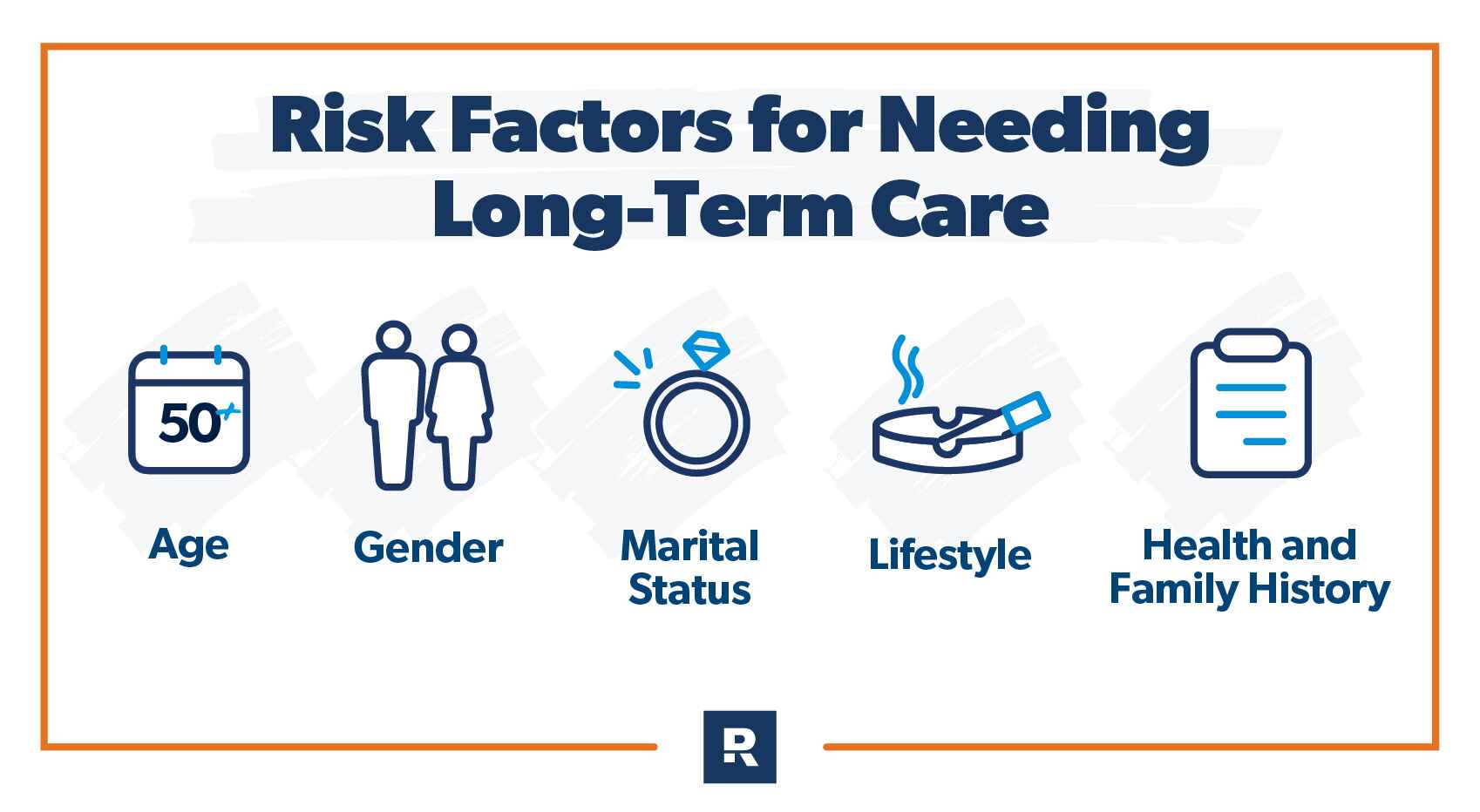

There are some factors that can push your risk up or down:

- Age: The older you are, the more likely you’ll need care.

- Gender: Women are more likely than men to need long-term care because, statistically, they live longer.

- Married or not: Without a spouse to provide some level of care, single people need paid care services more often.

- Lifestyle: If you smoke, never get off the couch, and have a crazy bad diet (hey, we all know better), you’ll be at a higher risk of major diseases and health conditions—and needing long-term care.

- Health and family history: That mini-stroke you had a couple years back could be genetic. Either way, if you’ve already experienced health problems or your family has a history of them, your risk is increased.

What Is Long-Term Care Insurance?

There are a lot of different insurances out there to cover a lot of different risks, so don’t feel bad if you’re asking, What is long-term care insurance? Long-term care (LTC) insurance helps cover costs related to a nursing home stay, assisted living facility, or caretakers coming to your house when you need help with daily activities like getting dressed or taking a bath due to health issues or because you’re just getting older.

Long-term care is an important decision. Connect with a trusted pro to make sure you have the right coverage.

For many Americans, LTC insurance is crucial since care like that can be so expensive—like really expensive. The average cost in the United States of one month in a nursing home is $8,910.2 (Yes, you read that right.) So you definitely want some kind of nursing home insurance in place.

The government estimates that someone turning 65 years old today will end up paying $120,900 for long-term care.3 But that doesn’t represent all the care that person will need. The average person will receive another $204,000 worth of unpaid care from their families. That means they’ll end up needing on average of $324,900 in care!4 And while regular health insurance won’t cover these costs, long-term care insurance will.

The federal government estimates the average 65-year-old will end up needing $324,900 worth of care. Simply put, long-term care is expensive.

What Does Long-Term Care Insurance Cover?

Long-term care insurance covers most of the expenses that aren’t covered by Medicare. (Surprise! The government isn’t going to take care of all your needs . . . more on that in a minute). Costs could be for things like:

- Nursing home care

- Assisted living facilities

- Adult day care services

- In-home care

- Home modifications

- Medical equipment

- Care coordination

One of the great things about long-term care insurance is that it covers in-home care costs. So you’ll be able to live in your home longer.

Some people might think Medicare will pay for at least the first few months of a nursing home stay. But not really. Medicare will pay for skilled nursing care during rehabilitation after things like a stroke or surgery. It can get confusing because some long-term care facilities like nursing homes also offer short-term care like rehab in the same building complex. But Medicare is a type of health insurance and will not cover long-term care.

To make it even more confusing, you may end up needing both kinds of care—which you could receive in the same facility and would get paid for by different entities. For example, you could need rehab at first, which is skilled nursing care and would be paid for by Medicare, but then also need ongoing help getting dressed, bathing, etc.—and that would be long-term care.

Types of Long-Term Care Insurance Policies

If you know anything about insurance, you’ll have guessed there’s more than just one kind of LTC insurance. Part of answering the question, What is long-term care insurance? is sorting through the different kinds. (You should also know they’re not all created equal.)

Traditional Long-Term Care Insurance

Traditional long-term care insurance is a no-frills, stand-alone insurance policy. It will pay for long-term care services when you need them. That’s it!

You pay an annual premium for a set amount of coverage. You choose how long the term of your coverage will go (often two to three years) and how much money you’ll get (also called a benefit). You’ll want something in the neighborhood of $150,000–300,000 because the average cost for LTC insurance is about $300,000.

Once you start using it, your policy will cover your expenses until you reach the benefit limit or the term period ends. (Translation: If you bought a $200,000, three-year policy and it cost $100,000 a year to stay in your nursing home, you’d be covered for two years.)

Hybrid Life and Long-Term Care Policies

Another option is a policy that combines life insurance with long-term care coverage. With a hybrid policy, you can access the death benefit—the money your beneficiaries would receive when you die—while you’re still alive to pay for long-term care.

And if you end up not needing care, your heirs get the full payout. Rates are considered noncancelable, which means premiums are fixed for life.

But brace yourself—the price tag for a hybrid policy is usually thousands of dollars more than a traditional policy. That’s because you’re also buying life insurance you might not even need along with long-term care coverage. And unlike traditional long-term care insurance, the premiums for hybrid policies are not tax deductible.

Similar to whole life insurance, a hybrid policy means the insurance company is investing your money for you. The problem is, they’re not making good investments, and your returns will probably barely keep up with inflation. If you take into account all the lost earnings (what you could’ve made if you invested the money yourself), hybrids may be the most expensive long-term care policy of all. That’s why hybrid policies should generally be your last resort.

The only time you might consider buying a hybrid is if you don’t qualify for a traditional long-term care insurance policy based on your health status. If that’s not your situation, buy long-term care insurance and life insurance separately—don’t try to marry the two! (We always recommend term life as your best option to protect your family’s future.)

Understanding State Partnership Plans

Like we said earlier, we don’t recommend shoving off your end-of-life-care responsibilities onto the state. But a lot of people do.

To help relieve the burden on Medicaid, several states came up with a partnership plan to encourage people to buy long-term care insurance. The plan lets folks receive Medicaid benefits after their insurance runs out—and still keep assets like their home and car.

Basically, these partnership plans allow people to buy a smaller plan with a lower premium while still getting the protection they need.

Although they call the plans by different names, many states have these partnerships available (Alaska, Hawaii, Mississippi and Utah officially don’t).5 Make sure you check with your state, though, because some states like California have the program but don’t have any companies that offer the plan.

Like the name sounds, long-term care partnership programs are a partnership between LTC insurance companies and the state. People buy LTC insurance from a participating company. When they go into care, their insurance covers the first part. After the insurance runs out, Medicaid kicks in.

Now, usually, you have to be pretty much broke to qualify for Medicaid—we’re talking your net worth is less than $2,000 (this means you can’t have any assets, including a house or car, that total above $2,000). If you do have a house when you pass away, Medicaid will take any proceeds from the sale of your house as compensation for the cost of your care. But in this partnership deal, Medicaid will pay for your care and allow you to keep whatever assets you own up to the amount that your LTC insurance already paid for your care.

If you’re feeling like you’re coming down with dementia just from reading that, don’t worry. Let’s look at an example:

At 65 years old, Esther owns her house worth $280,000 and a car worth $15,000. This savvy senior decides to buy an LTC partnership policy for $300,000. This means up to $300,000 of her assets will be protected if she needs to rely on Medicaid.

Within four years, Esther has a stroke and ends up in a nursing home. Her LTC insurance foots the bill for her first three years. But Esther’s still going strong, winning at bingo, and refusing to eat the green Jell-O (because it’s gross). So, because she has a partnership policy, Medicaid kicks in and pays for the last year of her long-term care. When she passes, her kids get her house and car. The fact is, Esther could’ve stayed another two years in the nursing home on Medicaid and her assets still would’ve gone to her kids rather than being sold to reimburse the state.

If your state offers it, getting LTC insurance through a state partnership carrier could be a really smart way to protect your assets in case you end up living to 102 (or your nursing home stay just lasts a lot longer than you planned for).

How Does Long-Term Care Insurance Work?

Let’s go over exactly what it will look like to use your LTC insurance.

First things first: When you buy a policy, you’ll decide how much insurance you want. LTC insurance lasts for a set period or term (often three years) and a set maximum lifetime benefit (aka total amount of money they’ll pay out for your care). Generally, you pay an annual premium.

Instead of a deductible, you have an elimination period with your policy. You can choose to wait 30, 60 or 90 days before your policy kicks in and insurance starts footing the bill. This means you pay out-of-pocket for the first one to three months of care.

You have a couple options when it comes to how your payments are distributed—although most policies come with the first option.

You can get a maximum daily limit that means insurance will only reimburse you for a set dollar amount of care per day. So say your daily limit is $350 and it costs $216 a day in a nursing home. But then you need an extra procedure one day that costs $1,000. Even though if you add up your daily coverages your total coverage for the whole month is $10,500, you’d still have to cover the extra $784 with your own cash because it’s above your daily limit.

The other option is to have a monthly limit—that way you’re still covered for days where care spending is extra high. Your monthly limit could be $10,000 which equals roughly $333 per day. Say your regular daily costs for care are $200. You could have an incident (like get sick or have a stroke) that makes your care costs go up for several days during a month and it would still be covered as long as the total for all the days isn’t higher than $10,000.

Finally, if you don’t recover before your set LTC insurance term is up, you’ll then have to depend on your own resources or Medicaid.

What Disqualifies You From Long-Term Care Insurance?

If you’re asking, What is long-term care insurance? you also probably want to know if anything disqualifies you from buying it. Well, not everyone can buy LTC insurance, sadly. Just like with other kinds of insurance, there are some conditions insurance companies consider too risky to cover.

While different carriers have different rules about what disqualifies you from long-term care insurance, all of them require that you be at least 18 years old to buy.

Apart from being a legal adult, here are some common reasons why you might be disqualified from LTC insurance:

- A major health condition (in addition to many diseases, this includes already using a three-pronged cane, crutches, oxygen or a wheelchair)

- Being too old (85 years or older is considered elderly and generally too risky to insure)

- A criminal record (especially a felony)

- A history of substance abuse

Because the risk of you needing to use the insurance is too high, companies won’t insure you if you check any of these boxes. That’s why it’s so important to look into LTC insurance way before you might need it!

When Will Long-Term Care Insurance Benefits Become Available?

When does an LTC insurance policy kick in? The policy is triggered when you can no longer perform 2 out of 6 activities of daily living:

- Dressing

- Bathing

- Eating

- Caring for incontinence

- Mobility

- Using the toilet

Your policy can also start if you suffer from severe cognitive impairment (aka if you can’t do things like speak or make decisions).

We touched on this earlier, but LTC insurance policies have an elimination period or wait period. You can choose from a 30-, 60- or 90-day elimination period. This means you have to wait one to three months before your benefits become available.

This period works as a deductible. Instead of you paying a lump sum before insurance will cover anything, you pay for care for a set period of time. Like with a deductible, the bigger (longer) your elimination period, the lower your premium. And the same rules apply for choosing between the lengths as they do when picking a deductible. If you have enough cash saved, you can pick a longer elimination period to save money.

If you’re budgeting for this, you’ll want to make sure you have a big enough stash to cover those first days of care. Multiply how much your daily or monthly benefit will be by the number of days in your elimination period and you’ll know how much you need saved to cover the wait.

As far as the actual payout goes, the typical long-term insurance policy provides a daily benefit dollar amount (but sometimes you can choose monthly).6 The daily limit can vary widely based on what you buy—under a hundred dollars to upwards of $500. A typical policy will pay out until a total limit is reached—often three years’ worth, but again, this is based on how much you buy and the cost of the care you receive.

Interested in learning more about long term care insurance?

Sign up to receive helpful guidance and tools.

Cost of Long-Term Care Insurance

Now we get down to business. How much this stuff costs.

The cost of long-term care insurance can vary pretty widely. Yearly premiums can run as low as $1,000 to around $10,000. The insurance company will look at things like your age, gender, location, current health and family health history. You’ll also pay more if you choose a longer term or a bigger benefit. Also keep in mind that your carrier can raise your premiums after you buy the policy.

Remember what we noted earlier about women having a much greater likelihood of needing long-term care than men? (According to federal data, women outlive men by about 5 years and need an average of 3.7 years of care as opposed to only 2.2 years for the average man.7,8) Well, that’s one of the biggest players in your premium price. Expect a hefty difference between what the ladies and gents pay. If you’re a man, you’re in luck—your insurance bill will be a lot less.

Depending on your gender, what options you select, and how old you are, a $165,000-benefit policy could run you anywhere from $900 as a man with no inflation growth included to $7,225 as a woman with a yearly 5% inflation growth rider. The good news is that couples get discounts. As a couple, your rate could range from $2,080 to $9,575.9

Long-Term Care Rates

We suggest buying an LTC policy for your 60th birthday (treat yo’ self, right?). So how much will this birthday present run you? For an LTC policy with $165,000 in benefits in 2023, it would cost the birthday boy about $1,200 a year while the birthday girl's will run $1,950.10

If you’re married, you can save a bit of cash by buying a joint policy that covers both you and your spouse at the same time with one pool of money. For a couple both age 60, their annual premium would cost $2,550 total.11

Now, these are for standard policies where the benefit does not increase with inflation. If you’re in good health, there’s a chance you won’t need this policy for a few years during which time inflation could eat a chunk of your payout value. An inflation rider on an LTC policy bumps up the policy benefit by 1–5% each year to help offset inflation. Sounds great, but it can more than double your premiums. The added cost could push your premiums too high—not worth it.

If you’re much older and just looking into buying LTC insurance, you might consider going for a higher monthly benefit (more than you would need currently) to build in cushion to cover future rising prices.

For a 60-year-old man, the premium for a policy with a 3% inflation growth option is $2,585. For a woman—same age—the price is $4,450.12 That’s a lot more. You’ll want to think carefully about your health, situation and whether the inflation rate is high enough to make it worth it. A local insurance pro can take a look at your situation and help you make the right decision.

|

Long-Term Care Insurance Rates per Age |

||

|

$165,000 Policy Benefit |

||

|

Age |

Sex |

Premium |

|

55 |

Male |

$900 |

|

55 |

Female |

$1,500 |

|

55 |

Couple |

$2,080 |

|

60 |

Male |

$1,200 |

|

60 |

Female |

$1,960 |

|

60 |

Couple |

$2,550 |

|

65 |

Male |

$1,700 |

|

65 |

Female |

$2,700 |

|

65 |

Couple |

$3,750 |

Data from the American Association for Long-Term Care Insurance13

Who Usually Pays for Long-Term Care?

So, the numbers don’t lie—most of us will end up needing long-term care. But who’s going to pay? Well, there are a few answers. It could be you, out of pocket. It could be Medicaid. Or it could be LTC insurance.

You should know, long-term health insurance isn’t a thing. If you think your health insurance will pay for long-term care, you need to think again. It won’t. You might think the government running in to save the day is the answer, but that’s also a bad bet. For Medicaid to even kick in and cover long-term care, you first have to use up whatever assets you have. This can mean you’re knocking on poverty’s door before Medicaid decides to lend a hand.

Side note: It’s common for kids to try to cheat the system by moving their folks’ assets around to try to get them to look broke so they’ll qualify for government help. This could be considered fraud depending on how you go about it. So be careful—the government will prosecute you! Don’t become a criminal just because you failed to plan ahead.

Sadly, many people have not planned ahead, and Medicaid pays for over half of long-term care in the U.S. In 2020, private insurance only paid for 8% of the $400 billion unloaded for long-term care costs, while Medicaid covered 54%.14 That means a lot of people had little to nothing left at the end of their lives!

Don’t put yourself in that position. Take care of your future self and buy LTC insurance if you need it.

Why Buy Long-Term Care Insurance?

What do people with LTC insurance have that others don’t: options.

When you can no longer get by on your own, you can choose what to do about it. Will you go into an assisted living facility? Do you want to stay in your home and have someone come to you? Would you rather go to the nursing home with the therapy cats or the one with the mountain views?

If you don’t have LTC insurance (or aren’t self-insured), you’ll be reliant on government assistance to get you through, and you’ll get whatever care they see fit to pay for. You may not get to stay in your home and sit in your favorite chair with the view of the neighbors’ goings on. You may have to go to a facility that is inconveniently far away from your kids. Whatever happens, you won’t have a choice.

And you’re going to need long-term care. The math says so.

We already touched on this earlier, but we’re going to say it again: The numbers show that if you’re 65 years old today, you have a 70% chance of needing long-term care, and roughly 20% of us will need it for more than five years.15

And this kind of care is expensive. The median annual cost of living in a private nursing home room is $108,405.16 In 2020, Americans paid $64 billion in long-term services and supports out of pocket—out of pocket!17 As in directly out of their savings and retirement funds. Why is this a problem? Take a look at Eric and Sadie.

These two soulmates weren’t always smart with money, but they worked hard and built up a nest egg of $300,000.

When Eric was 67 years old, he developed Alzheimer’s disease. At first, it wasn’t too bad. Sadie used some of their nest egg to hire a home care specialist to help for a few hours every day. But as Eric’s condition worsened, he eventually had to go into a nursing home. After two years in the home, Eric died. Sadie, now 72, is healthy for her age, but she has to work full time because her husband’s stay in the nursing home wiped out most of their nest egg.

Sadly, Eric and Sadie’s story isn’t unique. Only 7.5 million Americans have some form of long-term care insurance.18 That’s only 2.3% of U.S. residents!

But you can be different. You can set yourself up for success by having a plan. And that plan is called long-term care insurance.

5 Benefits of Long-Term Care Insurance

In case Eric and Sadie’s example wasn’t a big enough kick in the pants, let’s take a look at the five big benefits to having long-term care insurance.

1. Your assets will be protected.

You worked your whole life to save and invest for the future. Great job! But now that you’re getting older, the last thing you want is to spend a big chunk of your hard-earned cash on long-term care. (If you have a high enough net worth though, you may be able to self-insure.)

Long-term care insurance will keep that nest egg warm and cozy so you can have a more comfortable retirement. You’ll know that if you do become ill, you can afford the care you need and still have enough money left over so you and your spouse can eat.

2. Your loved ones won’t have the full burden of care.

When you or a loved one needs care, that responsibility can be a big burden on a spouse or family members. Sometimes the amount of care is more than a spouse or family member can handle. But without long-term care insurance, your family could be forced into a hard spot, shouldering the brunt of caring for you because there isn’t enough money for professional help.

Long-term care insurance can provide the extra support you and your family need through what can often be a challenging time. Plus, your kids won’t be burdened with huge payments for your care.

3. You and your family will have less stress with care management services.

Long-term care insurance doesn’t just pay for in-home care or a nursing home stay. It also can help with care management (or care coordination). This is someone who can come in and figure out the support you need, set it up, and supervise it to make sure you’re being taken care of. This extra support is a big blessing for family members during times that are often physically and emotionally exhausting.

4. You can live in your home longer.

Many people associate long-term care insurance with coverage that simply pays for a nursing home stay. But as we saw earlier, long-term care insurance also covers a lot of in-home expenses. You’ll be able to live in your home longer because of things like home modifications and medical equipment.

In-home caretakers can also make things much more comfortable for you as you deal with lower mobility and other health situations.

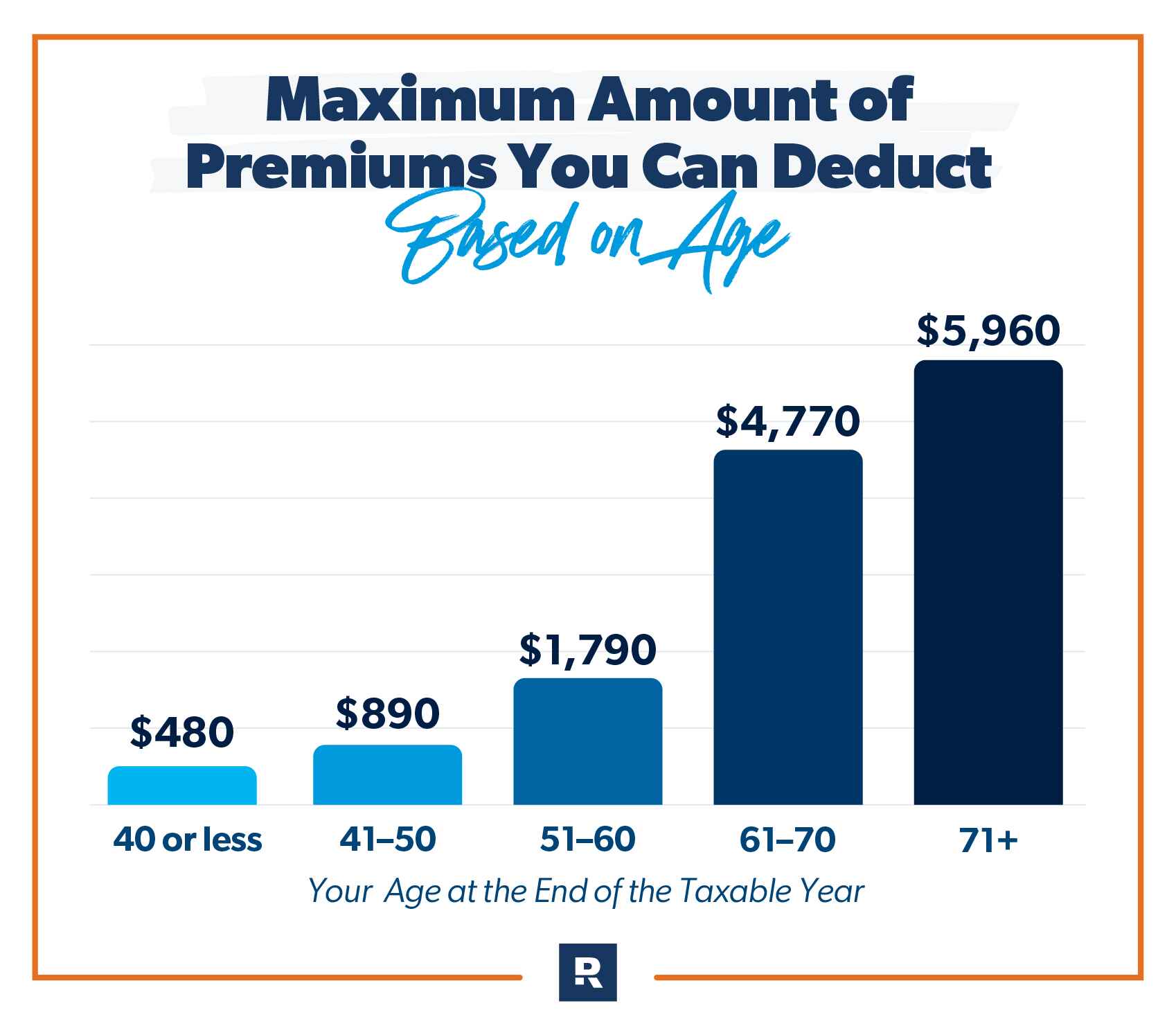

5. You’ll pay less taxes with tax-deductible premiums.

Long-term care insurance premiums are tax deductible up to a certain amount. So you’ll keep more of those Benjamins in the bank. And you might even be able to pay premiums out of a tax-free Health Savings Account. (More on tax advantages in a second.)

Tax Advantages of Buying Long-Term Care Insurance

Tax advantages aren’t just for the rich and famous. That’s right—you can pay Uncle Sam a little less and sort out your later years.

Depending on your plan, your state and how much you pay in premiums, you could deduct some or all of your long-term care premiums as medical expenses if you itemize your tax return.

But not all long-term care insurance plans qualify for these tax breaks, so ask an insurance pro to see if yours does.

Here’s a handy breakdown showing the maximum amount of your premiums you can deduct based on your age.19

When to Buy Long-Term Care Insurance

Like we mentioned before, it makes the most sense for most people to wait until age 60 to buy long-term care insurance because your chances of filing a claim before then is slim.

Get this—about 92% of long-term care claims are filed for people older than age 70, with most new claims starting after age 80.20 But remember, insurance is not one-size-fits-all. You need to do what’s best for you and your family. If you or your spouse has a family history of illness at a young age or you already have a few health issues, you may need to get long-term care coverage earlier. If you’re in your late 60s, you might feel like it’s too late, but it’s still good to see what you can qualify for.

You may have heard that you’ll pay less and lock in a lower monthly premium if you buy your policy at age 50 instead of age 60. That might be true, but you’ll also be dishing out money for an extra decade—for no reason. Buying something based the monthly payment is never a good idea. That’s what broke people do. Plus there’s no such thing as locking in a low LTC insurance rate because companies can change your rate anytime. Smart people buy what they need at the right time.

Many people worry that if they wait until age 60 to buy long-term care, they’ll develop a medical condition that will either prevent them from qualifying for coverage or significantly raise their premiums. If that’s you—if you have genetic health concerns or you’re losing sleep because you’re worried about getting sick and not being able to afford care—then buy long-term care when you can afford it. The peace of mind is worth more than any cash you’ll save on premiums. But don’t buy long-term care at a young age just because you think you’ll save money by doing it.

How to Buy Long-Term Care Insurance

You can either buy long-term insurance on your own or you can work with an insurance agent. Some employers also offer group plans as part of their benefits package. The benefits of working with an independent insurance agent is that you can lean on their expertise about all the different long-term care insurance options so you can decide what’s right for you.

The next step is to fill out an application. You’ll answer a few questions about your health status. Also be prepared to provide medical records if they’re requested.

Next, you’ll go through an interview process over the phone or sometimes in person.

You’ll then choose the coverage that fits your needs. Pick a term length and benefit (the amount your insurer will pay). When you need in-home, assisted living or nursing home care, your insurer will pay your monthly benefit to help cover those costs for the length of your term.

Once it’s approved, you start paying the monthly premiums and you’re good to go!

Finally, keep in mind that long-term care insurers may deny you if you have a number of health issues. One of our trusted insurance pros can help you find out if you qualify for traditional long-term care insurance. And if you do have a disqualifying health issue, they’ll help you understand your other options—so you can get the care you deserve.

The Best Way to Get Long-Term Care Insurance

We’ve answered the question, What is long-term care insurance? and a lot of other burning questions, but there’s still one more:

What’s the best way to find long-term care insurance?

Through an independent insurance agent. They’ll shop around several different long-term care insurance companies and get you quotes that can save you thousands of dollars and loads of unnecessary worries. Long-term care is an important decision, so make sure you get a professional on your side!

Don’t know where to look? Get in touch with a RamseyTrusted insurance pro. They’re insurance experts and can answer all your questions. Your pro will listen to your needs and help you make the right decision for you, your family and your budget.

Once you get a solid long-term care insurance policy in place, you’ll have a lot more peace of mind when you think about growing old.

Contact an independent insurance agent today!

Do You Have the Right Insurance?

Take the coverage checkup to find out what insurance coverage you should add, tweak, or drop based on your individual needs.

Frequently Asked Questions

-

How popular is long-term care insurance?

-

Not as popular as it should be! Only $14 billion of the over $400 billion spent on long-term care in the U.S. was paid for by LTC insurance in 2020. Americans spent $7 billion out of pocket for long-term care, and Medicaid picked up a whopping $162 billion.20 This means a lot of folks were at poverty level in their last days.Bottom of Form

-

Is long-term care insurance worth it?

-

Yes! Without long-term care insurance, you’ll have to pay out of pocket—and that’s expensive. Long-term care costs around $234,000 in the last five years of a person’s life—or $367,000 if that person has dementia.8 If you have a high enough net worth, you may be able to self-insure. But if you can’t pay, you’ll have to depend on your family and friends to care for you at home or pay for professional care.

-

What happens when Medicare stops paying for nursing home care?

-

Medicare never pays for nursing home care. It will pay for skilled nursing care during rehabilitation after things like a stroke or surgery. People may get confused because some long-term care facilities like nursing homes also offer short-term care like rehab in the same building complex. But Medicare is a type of health insurance and will not cover long-term care.

-

Doesn’t Medicare or Medicaid cover long-term care?

-

Don’t make the mistake of believing Medicare will cover long-term care costs. It won’t. Medicare only pays for hospitalization and short-term rehabilitative care in a skilled nursing facility, and it only covers you for up to 100 days.

And while Medicaid—the government program for those who truly don’t have any money—will cover long-term care expenses, it should never be your first choice. You won’t have the quality of care you want, and you’ll have limited options.