Can Young People Buy a Home in 2024? These 5 Millennials Proved It’s Possible

8 Min Read | Aug 13, 2024

Spend some time scrolling through money and finance content on TikTok or Instagram, and it won’t take you long to become convinced that young Americans are destined to never own a home.

You’ll quickly run into a finance “expert” discussing how home price inflation has made saving up for a down payment impossible, a comedian complaining that they won’t own a home until they inherit their parents’ house, or a TV news station airing a doomsday story about the death of homeownership.

There’s a problem with that narrative, though: It’s not true.

Now, homeownership in America has gotten drastically pricier over the last four years, with the median home sales price jumping to $420,800 and the typical interest rate for a 30-year mortgage hovering around 7%.1,2

But even though homeownership is a much bigger challenge for young people these days, it’s far from impossible. After all, millennials represented the largest group of home buyers in 2023, and 26.3% of adult Gen Zers own a home.3,4

How are they doing it, though? What’s their secret sauce?

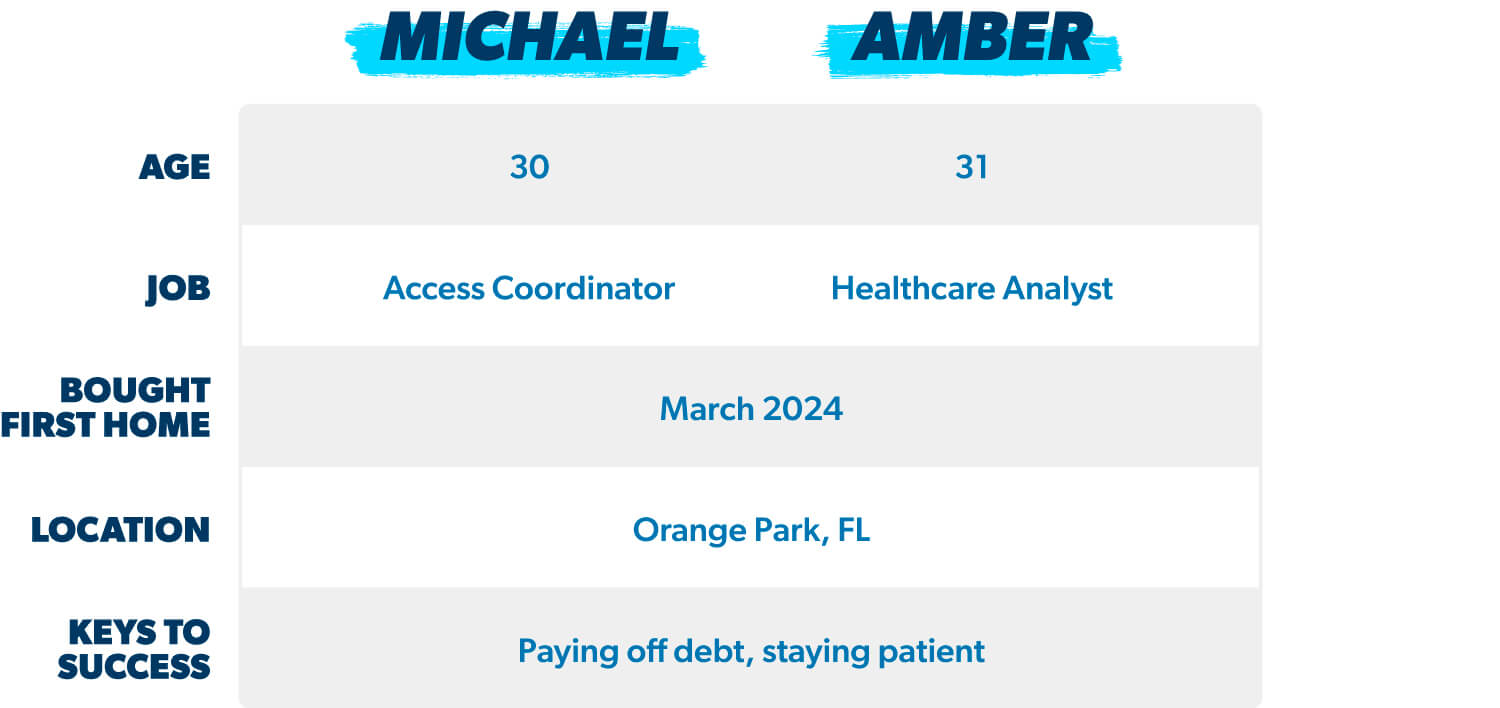

“There is no magic formula or trick to purchase a home,” said 30-year-old Michael Llanes, who bought a home in 2024 with his wife, Amber. “All you need to do is spend less than you make, buy only the necessities to live a comfortable life without all the bells and whistles, and save the extra money you don’t spend.”

Ditching Debt

A fire. Another fire. A break-in. Another break-in. A shooting. Another shooting that killed someone in the parking lot.

No, that’s not the description of an upcoming summer action movie—it’s a sampling of what went down at Michael and Amber’s apartment complex in South Florida before they finally moved out in 2024.

Both in their late 20s at the time, Michael and Amber decided they were ready to get the heck out of that complex and buy a house four years earlier. But even though they’d been saving since 2018, they weren’t even close to having enough money to make a 5% down payment.

When they looked at their situation and crunched the numbers to see why they were having trouble saving money, it didn’t take them long to find the smoking gun: car payments.

Michael and Amber had nearly $50,000 in combined car debt, which amounted to $800 a month and nearly $10,000 a year in payments. It was killing their progress.

So, Amber started looking for a way out. Before long, she found The Ramsey Show and started hearing one our biggest messages: Get out of debt—and stay out.

It’s a message Amber connected to immediately.

“I stumbled upon Dave Ramsey, and just felt like it was God-sent,” she said. “He’s teaching us these principles and values, and I just mentioned to my husband, ‘Hey, we need to get these cars off our shoulders.’”

That’s exactly what they did.

They paused their house savings, started attacking their debt, and finished paying off the cars in 2021.

Michael and Amber then went right back to saving up for a down payment. And with no car payments on the books—or any other debt payments—their pile of cash began growing quickly.

“It really started exploding,” Michael said.

“We pinched our pennies, and started saving, saving, saving,” Amber said. “We were just so ready to get out of our apartment.”

On February 7, 2024, the Llanes couple finally accomplished their goal. They closed on a four-bedroom house in a suburb of Jacksonville, making them homeowners in their early 30s—a target that seemed unattainable back when they were spending $800 a month on their cars.

Find expert agents to help you buy your home.

“That morning was surreal,” Michael said. “Realizing all the sacrifices we had to make to get to that point, and all the time we had to rely on each other to make our dreams come true, made both of us feel extremely blessed.”

Staying Focused

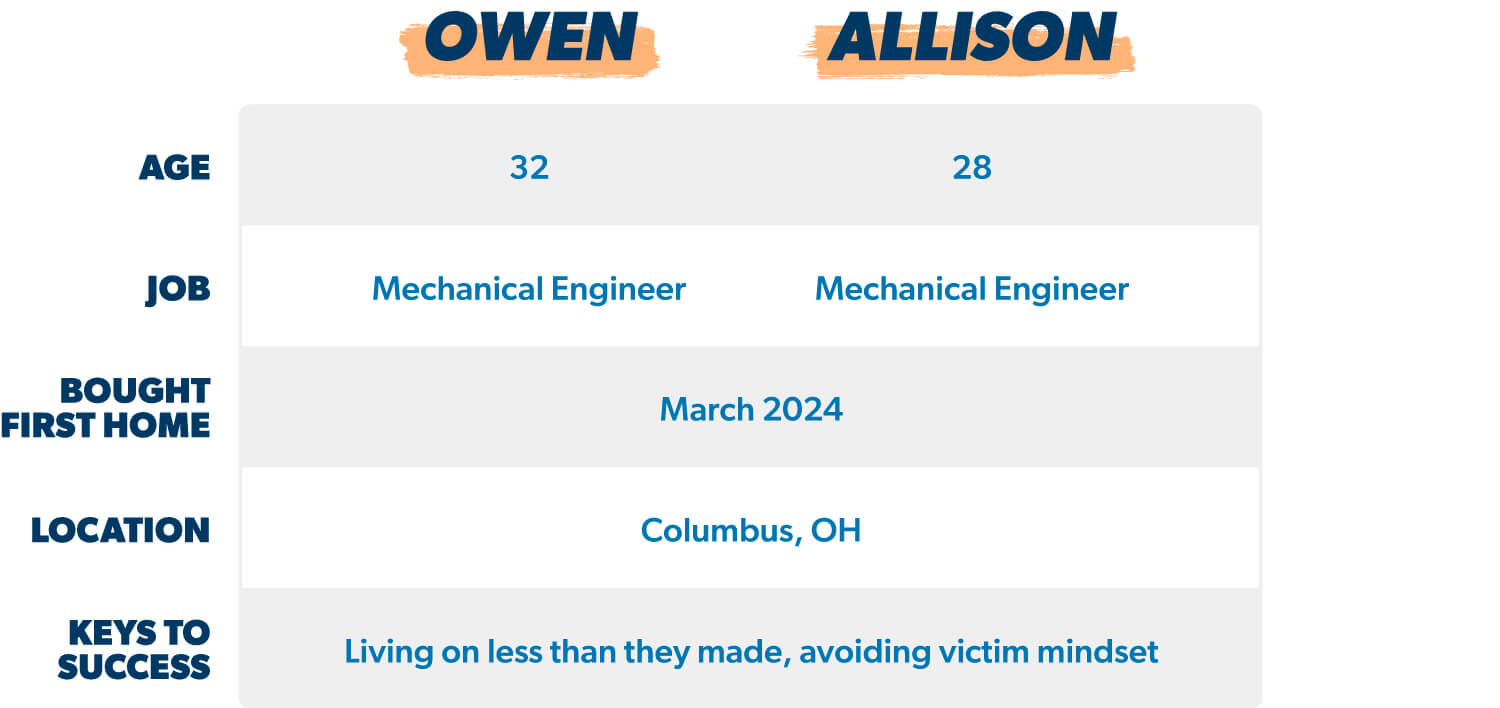

Michael and Amber aren’t the only young millennials who’ve managed to become homeowners in the last couple of years despite the cost. Owen and Allison Meehl from Columbus, Ohio, joined the club in August of 2023.

Their main ingredient? Focus.

The Meehls wanted to follow our guidance by keeping their monthly house payment below 25% of their take-home pay. So, they set a goal to make a 20% down payment—hoping that would keep their payment low.

But it wasn’t long before the real estate market began exploding and prices got out of hand, something that led many would-be home buyers to throw in the towel.

Not the Meehls, though.

Sure, they were discouraged. But they also refused to give up or adopt a victim mentality, choosing instead to lock in and stick to their goal—even knowing it was going to take much longer than they anticipated.

“It would’ve been awesome to buy the same house for $200,000,” Owen said. “It would be nice to have a 2% interest rate too, but we weren’t there. I don’t have any emotional baggage about what we missed out on, because it just wasn’t the right time.”

After five years, Owen and Allison hit their goal, making a whopping $100,000 down payment on a $330,000 house.

They got there by keeping margin in their budget, living on less than they made, and keeping their spending under control—lifestyle choices that felt less like a major sacrifice or burden and more like simply being intentional.

“I didn't feel like I was living a lesser life. I was just living a life that didn’t need to have the fanciest new car or the fanciest washer and dryer,” Allison said. “I wasn’t frivolous.”

Resetting Expectations

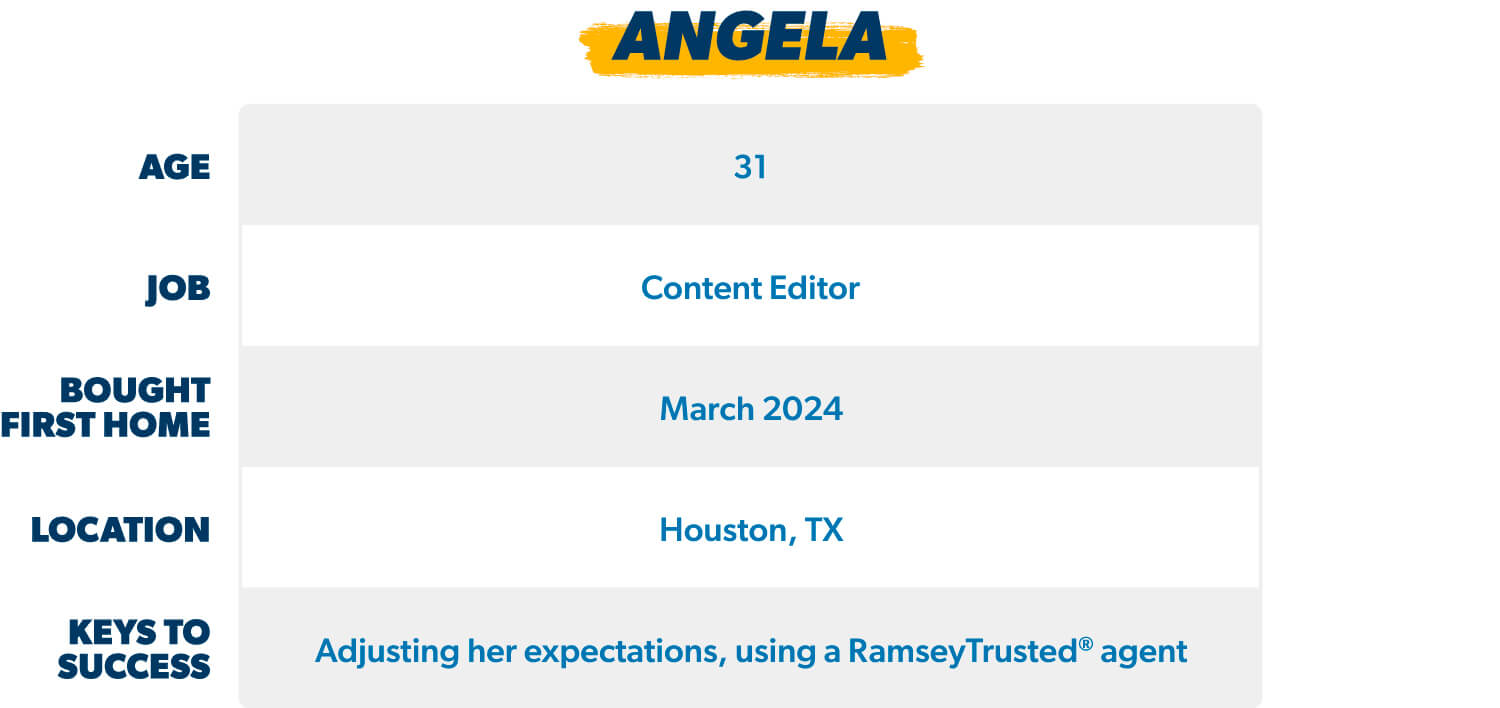

But don’t think that the only young people finding a way to buy a home these days are married couples with a two-income household. Plenty of singles, like 31-year-old Angela Lopez, are making it happen too.

In 2023, Lopez grew tired of renting and decided she wanted to buy a house near her apartment in the suburbs of Houston. But could she make it happen as a single person with one income? To Lopez, it wasn’t even a question.

“There wasn’t any doubt that I could get to the number I wanted,” Lopez said.

Once she set her savings goal—a 20% down payment on a traditional single-family home—Lopez got to work. She dialed in her budget, set up a separate savings account with an automatic transfer every month, and avoided unnecessary spending along the way.

But as she started saving and crunching the numbers, Lopez ran into a problem: She quickly realized that her initial goal of buying a single-family home was out of reach because the monthly payments would simply be too big.

That didn’t stop her, though.

Instead of giving up, Lopez did something that became a key to her home-buying journey: She reset her expectations. She shifted to looking at condos and townhomes—both newer builds and fixer-uppers.

And after continuing to save for a little while longer, Lopez started working with a RamseyTrusted real estate agent and bought her first house in March 2024: an older townhome that needed some repairs.

It’s not her dream home, but she believes making that sacrifice and adjusting her goal was 100% worth it.

“It's not pretty, but I have a home I can afford in a nice part of town,” Lopez said. “I'm not going to be renting anymore, so I’m actually building equity. I don't regret it.”

“You can get it done."

You’ve probably noticed that there’s nothing too exciting about how these folks became homeowners. None of them used some kind of fancy financial maneuvering or the latest home-buying “hack.”

And although they all have good jobs, they aren’t C-suite executives with insanely high incomes. Michael and Amber Llanes each work desk jobs for a health care business, the Meehls are mechanical engineers, and Lopez edits reports for a construction company.

Boring, right? But here’s the deal: That’s kind of the point.

See, all it takes to buy a home is taking your time and working hard—and the people we just looked at prove that.

The Llaneses paid off their debt. The Meehls stayed focused and disciplined. Lopez reset her expectations. And eventually, they all wound up as homeowners before turning 33. Talk about flying in the face of all those real estate hope stealers online.

“You can’t believe everything you hear on the internet,” Michael Llanes said.

The best news about the strategy they all used? You can use it too.

“It sounds cliché, but, honestly, you can do it if you focus on it and put your mind to it,” Lopez said. “It’s probably not going to be exactly what you wanted—I had to make some tradeoffs to get into a home. But I still did it.

“If you decide that that’s what’s important to you, you can get it done.”

Your All-in-One Real Estate Resource

Find everything you need to help make confident decisions and reach your home goals.