Boost student engagement and reduce cell phone distractions.

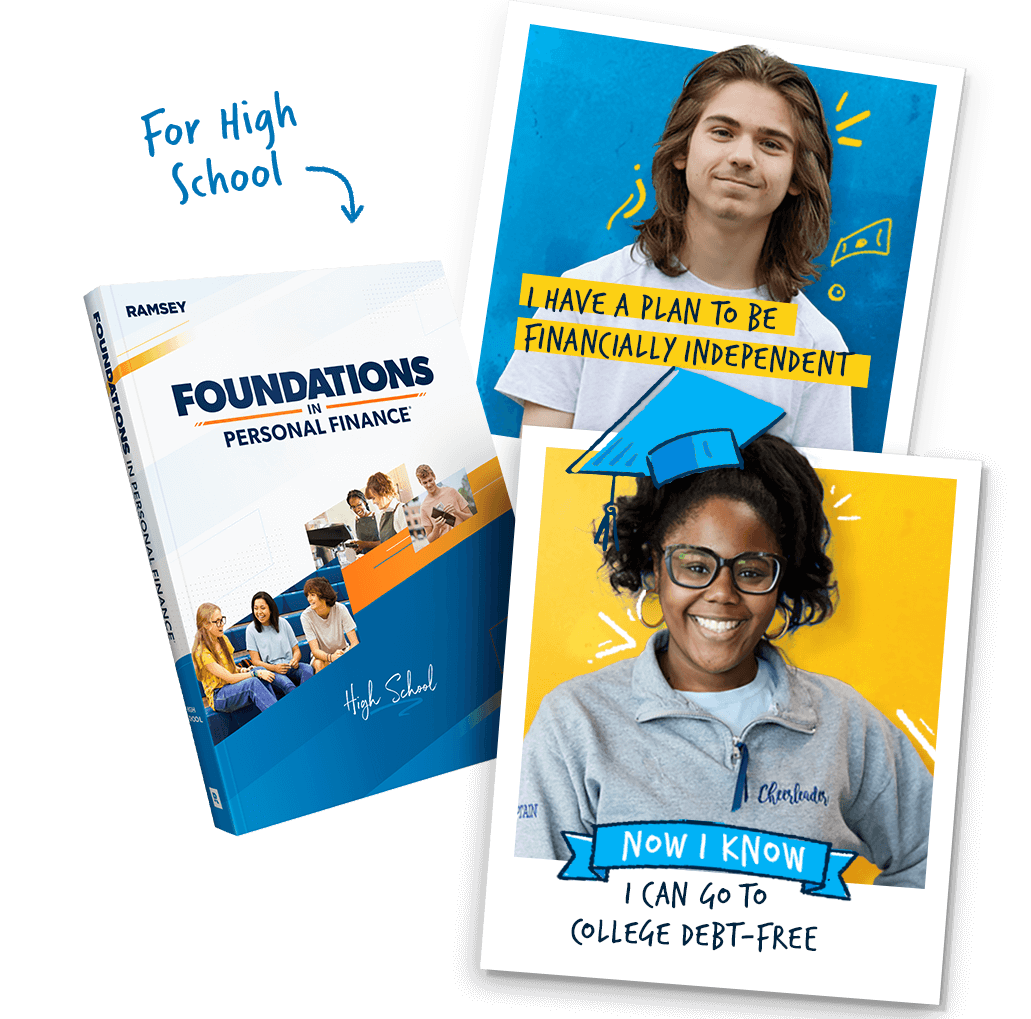

Use Foundations in Personal Finance curriculum in your class to engage students and show them a hopeful future.

Your role matters more than you know! So we’re here to help. With our curriculum, you can:

Boost student engagement and reduce cell phone distractions.

Give students skills they’ll want to apply now and in the future.

Spend more time with students and less time prepping and grading.

Your role matters more than you know! So we’re here to help. With our curriculum, you can:

Boost student engagement and reduce cell phone distractions.

Give students skills they’ll want to apply now and in the future.

Spend more time with students and less time prepping and grading.

Fill out the form to connect on a 5–10 minute phone call.

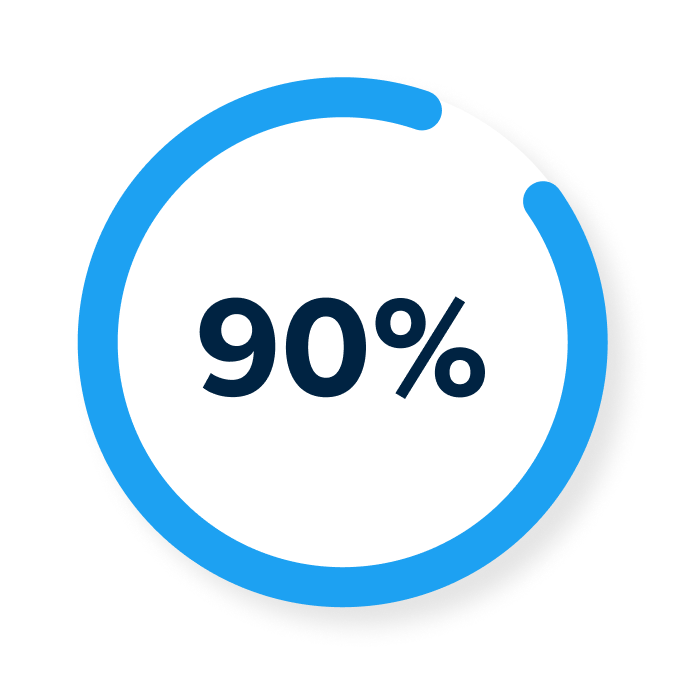

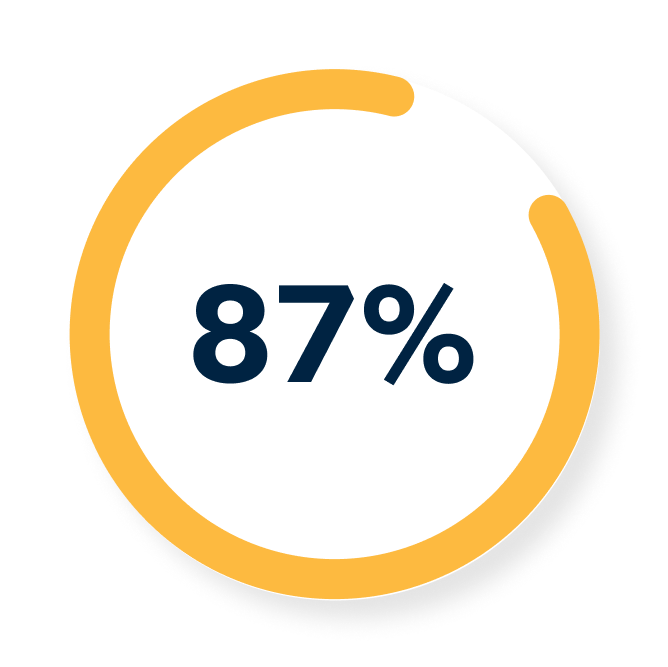

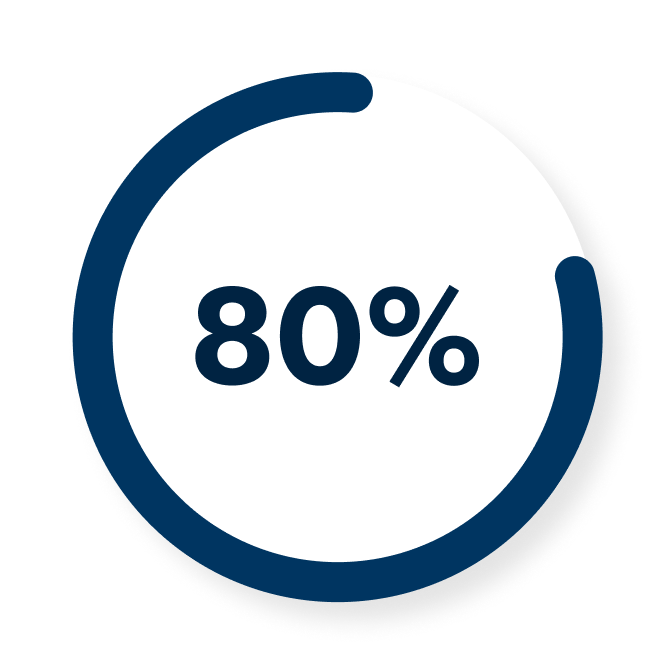

In a survey of 3,851 students who took a Foundations in Personal Finance course:

Believe it’s possible to graduate

from college debt-free.

Have specific goals

for their money.

Are more likely to have an

emergency fund after the course.

Source: The Ramsey Education Curriculum Effectiveness Survey, 2023

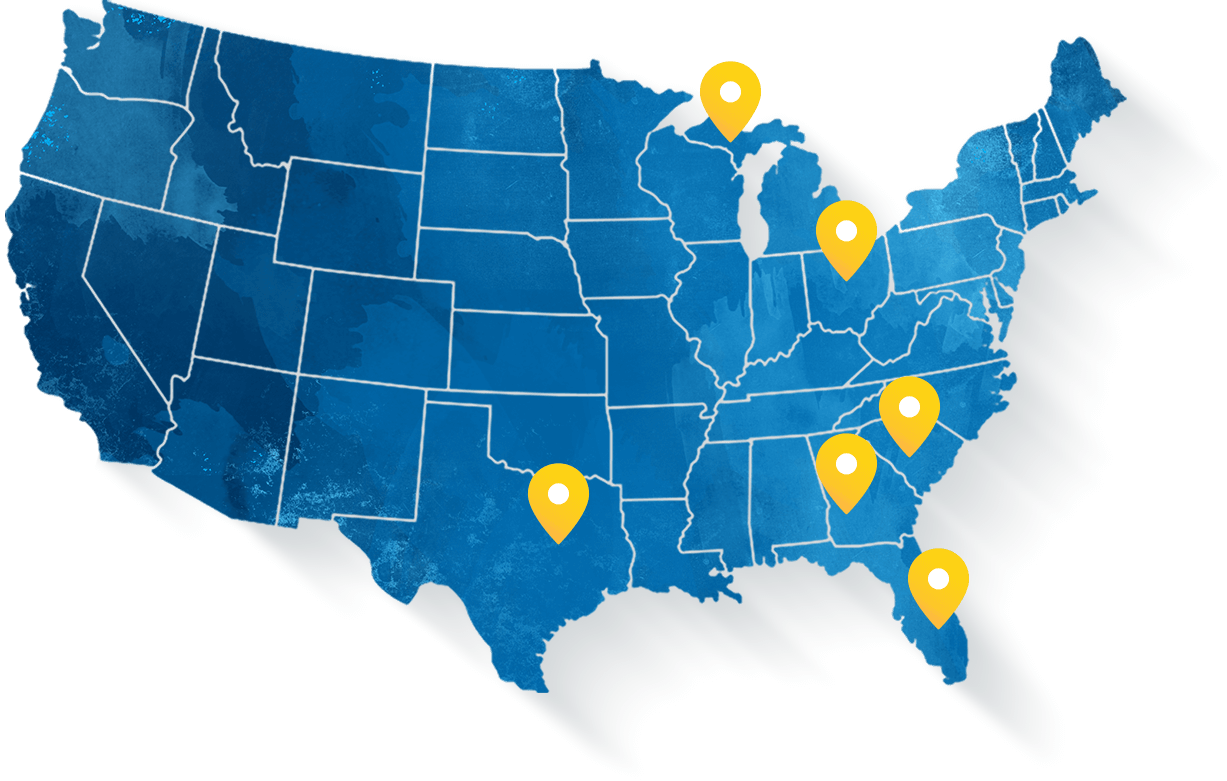

See how Foundations meets state and national standards for personal financial literacy.

The Foundations in Personal Finance curriculum meets or exceeds standards in all 50 states. The curriculum also meets all national standards for personal finance.

National Jump$tart

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Texas Proc '24

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming

The Foundations in Personal Finance high school curriculum consists of 13 chapters of essential personal finance principles like how to budget, save, avoid debt, invest, be a wise consumer and much more!

Introduces the topic of personal finance, explores the evolution of credit and consumerism in America, and highlights the importance of both knowledge and behavior when it comes to managing money.

Dives into why budgeting is key to taking control of money—and how students can get started right now.

Emphasizes the importance of saving and explains three reasons why students should save money: emergencies, large purchases, and wealth building.

Identifies the dangers of debt, debunks some credit myths, explains the credit report and score, and provides practical strategies to get out of debt—and stay out.

Highlights the importance of being a smart consumer as part of a healthy financial plan, explains strategies to manage spending behavior, exposes common consumer scams, and identifies consumer rights.

Examines how students can find the right career path and create strategies to land a job they’ll love so they can thrive and enjoy their work. They’ll also discover tips for building a resumé and presenting themselves well during a job interview.

Explores the variety of educational options available after high school, highlights the dangers of student loans, and explains how students can pay cash for college and avoid student loan debt.

Explores the services provided by banks and credit unions, including the different options and features. Students will learn about responsible banking, how to manage their accounts, and the importance of keeping records.

Breaks down the purpose of insurance, explains how insurance works, shows how insurance protects a person’s assets, and highlights the eight basic types of insurance everyone needs to have in place.

Digs into a huge reality in life: If someone earns an income, they’re going to pay taxes. This chapter also breaks down the basics of different types of taxes—like sales, excise, and federal taxes—including how they impact a person’s income and spending.

Identifies the differences between renting and homeownership. Students will discover the financial costs related to having their own place to live, and they’ll learn what to do when they’re ready to buy a house.

Dives into the basics of preparing for retirement, investing for the future by understanding the stock market and mutual funds, and planning to live a life bursting with generosity.

Examines how the global economy impacts personal financial decisions and how different global economic systems influence decisions about goods and services that are used around the world.