💡 Create a lightbulb moment with your students this school year.

Provide hope, confidence and life-change with a high school curriculum that meets national and state standards. Choose your state to get started with Foundations in Personal Finance.

Foundations has 13 flexible chapters with real world topics like saving, investing, college planning, global economics, and more!

Let's find the right curriculum for you.

We look forward to connecting with you soon!

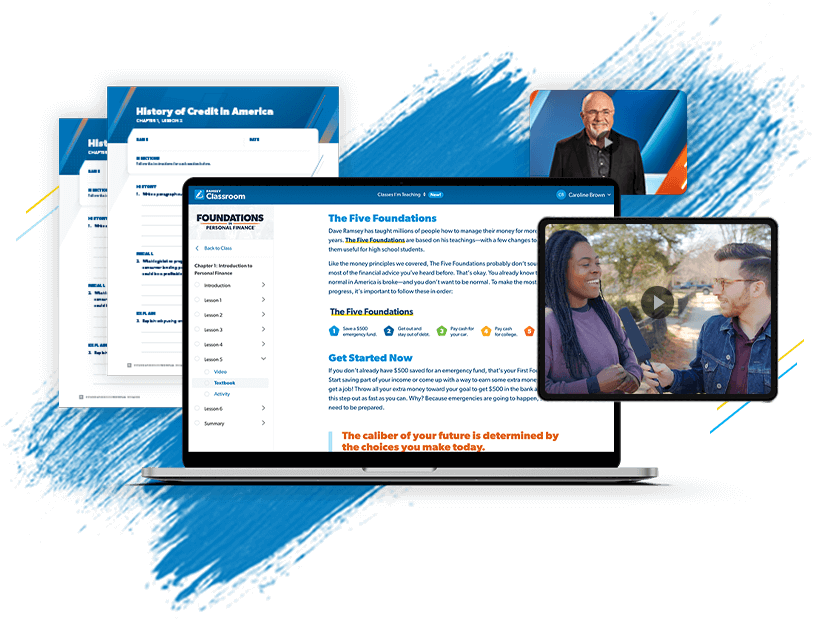

Flexible for Any Learning Environment

Teaching remotely? Back in the classroom? A mix of both? We’ve got you covered!

We’re Here to Help

Get access to tools and support that will help you win in the classroom.

Flexibility for Any Learning Environment

Teaching remotely? Back in the classroom? A mix of both? We’ve got you covered!

We’re Here to Help

Get access to tools and support that will help you win in the classroom.

Trusted Content

Be confident that what you’re teaching will make a difference that lasts a lifetime.

Trusted Content

Be confident that what you’re teaching will make a difference that lasts a lifetime.

Try Foundations today—for free!

That’s right. Test-drive the curriculum with a free trial. You’ll get access to all of Chapter 1—including reading content, video lessons and classroom activities.

Looking for standards correlations?

"Teaching this course is like teaching a part of my heart. The students in my classes will have opportunities and wealth they may not have otherwise had because of what they are learning.”

— Dara, Foundations teacher

Wait, there's more!

TABLE OF

CONTENTS

STANDARDS CORRELATIONS

TEXTBOOK ADOPTIONS

FREQUENTLY ASKED QUESTIONS

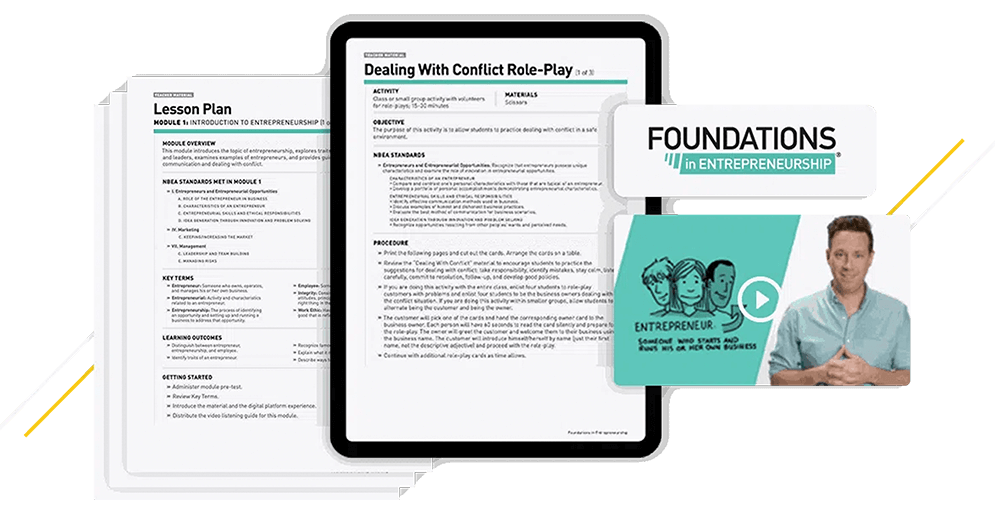

We also have an entrepreneurship curriculum!

Teach your students how to start and run their own business with Foundations in Entrepreneurship.

We also have an entrepreneurship curriculum!

Teach your students how to start and run their own business with Foundations in Entrepreneurship.

Hey, teachers! Get our newsletter with resources and updates just for you.

Our Foundations in Personal Finance curriculum has these Spanish language resources available:

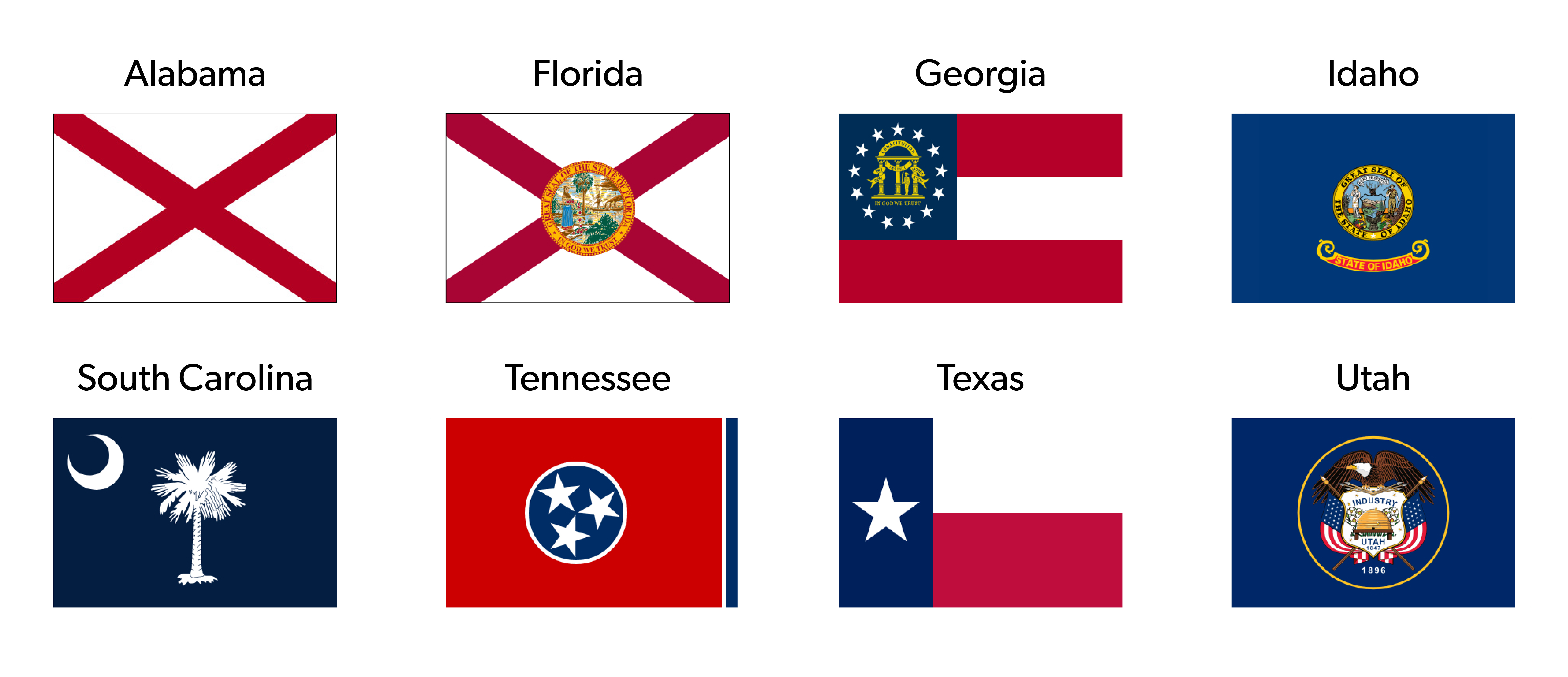

State and National

Standards Correlations

The Foundations in Personal Finance curriculum meets or exceeds standards in all 50 states. The curriculum also meets all national standards for personal finance.

National Jump$tart

Alabama

Alaska

Arizona

Arkansas

California

Colorado

Connecticut

Delaware

Florida

Georgia

Hawaii

Idaho

Illinois

Indiana

Iowa

Kansas

Kentucky

Louisiana

Maine

Maryland

Massachusetts

Michigan

Minnesota

Mississippi

Missouri

Montana

Nebraska

Nevada

New Hampshire

New Jersey

New Mexico

New York

North Carolina

North Dakota

Ohio

Oklahoma

Oregon

Pennsylvania

Rhode Island

South Carolina

South Dakota

Tennessee

Texas

Texas Proc '24

Utah

Vermont

Virginia

Washington

West Virginia

Wisconsin

Wyoming

Textbook Adoptions

We've worked hard to create the industry's leading curriculum on personal finance which meets or exceeds standards in all 50 states. As a result, editions of our curriculum have been adopted in the following states:

Table of Contents

The Foundations in Personal Finance high school curriculum consists of 13 chapters of essential personal finance principles like how to budget, save, avoid debt, invest, be a wise consumer and much more!

-

Chapter 1: Introduction to Personal Finance

-

- Lesson 1: Personal Finance and You

- Lesson 2: A History of Credit and Debt

- Lesson 3: It’s Time for a Change

- Lesson 4: The Road to Financial Success

- Lesson 5: Financial Literacy

- Lesson 6: Money Personalities and Relationships

-

Chapter 2: Budgeting Basics

-

- Lesson 1: The Benefits of Budgeting

- Lesson 2: Components of a Budget

- Lesson 3: Building a Zero-Based Budget

- Lesson 4: Tracking Your Expenses

- Lesson 5: Making Budgeting a Habit

- Lesson 6: Relationships and Budgeting

-

Chapter 3: Saving Money

-

- Lesson 1: Saving Money Takes Discipline

- Lesson 2: Three Basic Reasons to Save

- Lesson 3: Saving for Emergencies

- Lesson 4: Saving for Large Purchases

- Lesson 5: Building Wealth

- Lesson 6: Compound Interest and Growth

-

Chapter 4: Credit and Debt

-

- Lesson 1: Beware of Credit and Debt

- Lesson 2: Sources and Types of Credit

- Lesson 3: Credit Scores and Credit Reports

- Lesson 4: The Truth About Credit Cards

- Lesson 5: The Truth About Car Loans

- Lesson 6: Getting and Staying Out of Debt

-

Chapter 5: Consumer Awareness

-

- Lesson 1: The Psychology of Sales

- Lesson 2: Buyer Beware

- Lesson 3: The Marketing Machine

- Lesson 4: Becoming a Smart Spender

- Lesson 5: Protecting Yourself as a Consumer

- Lesson 6: Your Spending Behavior

-

Chapter 6: Career Readiness

-

- Lesson 1: Work Matters

- Lesson 2: Resumé and Interview Basics

- Lesson 3: An Entrepreneurial Mindset

- Lesson 4: The Path to Your Dream Job

- Lesson 5: Exploring Career Options

- Lesson 6: Be a Lifelong Learner

-

Chapter 7: College Planning

-

- Lesson 1: The Path to Intentionality

- Lesson 2: Explore Your Options

- Lesson 3: Consider the Cost

- Lesson 4: Reduce Your Cost

- Lesson 5: Build Your College Resume

- Lesson 6: Maximize Your Investment

-

Chapter 8: Financial Services

-

- Lesson 1: The Purpose of Banks

- Lesson 2: Types of Financial Institutions

- Lesson 3: Your Banks Accounts

- Lesson 4: Responsible Banking

-

Chapter 9: The Role of Insurance

-

- Lesson 1: Insurance is Important

- Lesson 2: Auto Insurance

- Lesson 3: Homeowners and Renters Insurance

- Lesson 4: Health Insurance

- Lesson 5: Life Insurance

- Lesson 6: Other Types of Insurances

-

Chapter 10: Income and Taxes

-

- Lesson 1: What Happened to my Money

- Lesson 2: Taxes on Your Paycheck

- Lesson 3: Income Tax Basics

- Lesson 4: Filing Your Income Taxes

- Lesson 5: Taxes on Other Types of Income

- Lesson 6: Taxes on Things You Buy

-

Chapter 11: Housing and Real Estate

-

- Lesson 1: Living On Your Own

- Lesson 2: Renting Vs. Owning

- Lesson 3: Renting 101

- Lesson 4: Buying a House

-

Chapter 12: Investing and Retirement

-

- Lesson 1: Money For the Future

- Lesson 2: Understanding Investments

- Lesson 3: Investing Through Retirement Plans

- Lesson 4: Protecting Your Investments

- Lesson 5: Planning For Retirement

- Lesson 6: Outrageous Generosity

-

Chapter 13: Global Economics

-

- Lesson 1: Macroeconomics and Global Activity

- Lesson 2: Economic Systems

- Lesson 3: The U.S. Economy

- Lesson 4: Thinking Globally

Frequently Asked Questions

You asked, we answered. Here are some of our most frequently asked questions about Foundations in Personal Finance: High School Edition.

Does Foundations in Personal Finance support online/virtual learning?

Yes! Foundations in Personal Finance is available in a fully digital option, as well as a print and streaming option. No matter what delivery method you choose, you’ll get a printed Teacher Guide.

Does Foundations in Personal Finance meet state and national standards?

Yes! The Foundations in Personal Finance curriculum meets state and national standards for personal financial literacy. See the standards correlations for your state for more information.

Does Foundations in Personal Finance support differentiated learning?

Yes! We have extended learning prompts specifically for differentiated learning in the Teacher Guide.

Are lesson plans and classroom activities included?

Yes! Foundations in Personal Finance is full of ready-to-teach classroom activities and lesson plans that will help you save time and allow you to feel confident about teaching Foundations.

How do I get a quote for Foundations in Personal Finance?

Simply fill out the form above, and our team will reach out to you to provide a quote based on your class size and student needs.

How long does it take to teach Foundations in Personal Finance?

Foundations in Personal Finance is designed as a semester-long course with stand-alone chapters. We provide you with 45-, 90- and 180-day pacing guides that you can choose from, but if you don’t need a full semester course, the stand-alone chapters allow you to make the course fit your schedule—not the other way around.

How many schools use Foundations in Personal Finance?

More than 45% of schools across the country have used the Foundations curriculum. This means more than 7 million students have learned how to budget, save, spend wisely, and invest. It’s a generation equipped to live out their dreams and give to the world around them.

Don't see what you're looking for? Contact your state's Curriculum Advisor at 615.843.9439